Dear Dave,

My husband and I have our emergency fund account in the same bank as our checking and savings accounts. Do you think we should move the emergency fund to a different bank? A friend suggested doing this, but I wasn’t clear on why he thought this.

Shari

Dear Shari,

Honestly, I wouldn’t worry about it too much if I were you. The only exception to that might be if you had loans you owed to that same bank.

Some commercial loan documents give banks the right to take money out of your accounts—without your permission—to pay the loan. This isn’t a common practice, and it usually doesn’t happen unless someone gets way behind on a loan. If you had a car loan with a particular bank, for instance, I wouldn’t keep a lot of money in that bank.

But in your situation, Shari, I think everything’s fine.

—Dave

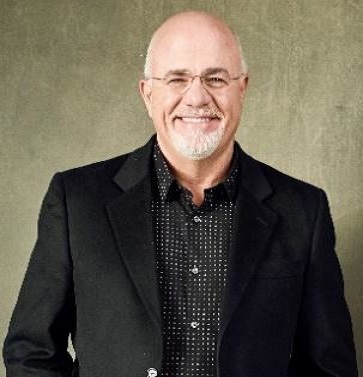

* Dave Ramsey is an eight-time No. 1 national best-selling author, personal finance expert and host of The Ramsey Show, heard by more than 20 million listeners each week. He has appeared on Good Morning America, CBS Mornings, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for the company, Ramsey Solutions.

.jpg)