Dear Dave,

My husband and I are having arguments about money where our children are concerned. They are both 16, and I think they should have part-time jobs and be learning the value of work. He feels they’re only young once and wants them to enjoy being teenagers. He also gives them money anytime they ask. I want our kids to have fun, too, but this is beginning to cause tension in our relationship. I’d love your advice.

Kaytee

Dear Kaytee,

I understand your concern. I’m sure your husband has a good heart, but by doing this he’s acting like a friend instead of a parent. In the process, he’s allowing them to be nothing but takers and consumers. He’s setting them both up for lifetimes of helplessness and ridiculous expectations without realizing it.

But yes, kids should absolutely learn to work, make money and manage it wisely from an early age. My wife and I gave nice gifts to our kids from time to time, but they also worked and made money for themselves. And the nicer gifts we gave them were for special occasions. Even then we didn’t go crazy with things.

Still, the biggest problem you and your husband are experiencing is a communication breakdown. Your husband should stop being so impulsive, and grow a backbone where the kids are concerned. You’ve recognized this—and you’re right about it—so it’s up to you to take the first step in finding a solution.

Try sitting down with him, just the two of you, and sincerely explaining your feelings. Let him know you love him and how generous he is. But let him know, too, you’re worried this is having a negative impact on your children and why. Talk it out, openly and honestly, and try to agree on some changes together. There’s a middle ground here, but it’s going to take some time and effort from both of you to reach it.

Most of all, it means you two will have to communicate with each other like mature, caring adults, and pull together for the sake of your kids. It might be difficult at first, but it’ll be worth it in the long run. For you and them.

Thanks, Kaytee!

— Dave

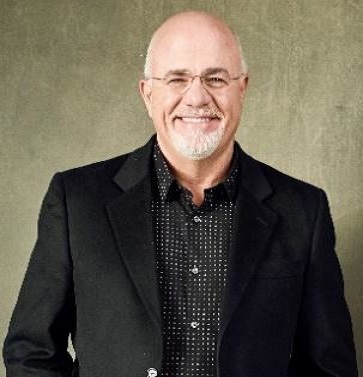

* Dave Ramsey is an eight-time national bestselling author, personal finance expert and host of The Ramsey Show. He has appeared on Good Morning America, CBS This Morning, Today, Fox News, CNN, Fox Business and many more. Since 1992, Dave has helped people take control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.

.jpg)