Dear Dave,

I read where you recommend saving 15% of your income for retirement. Should I count my employer’s contribution to my retirement plan as part of that 15%?

Carlotta

Dear Carlotta,

That’s a great question. Employer contributions do not count toward the 15 percent I recommend setting aside for retirement. It’s great if you work for a company that offers perks like that, but I want you putting 15 percent of your money into retirement. Whatever your company matches, whatever its pension may be, or even having a military retirement package, none of that enters the equation. I want your money in your name.

Baby Step 4 of my plan says to put 15 percent of your income into retirement accounts. The first thing you should put money into is a matching retirement account. If you’ve got a 401(k), a Roth 401(k) or a 403(b) and your employer offers a match, you should do that up to the match before anything else.

Let’s say your employer will match three percent. Since the goal is 15 percent, that still leaves you with some work to do. You’ve got three percent of your own money already going into retirement, so then you could look at a Roth IRA. If the Roth, plus what you invested previously to get the match doesn’t equal 15 percent, then you could look at a 403(b), or go back to your 401(k) to hit the 15 percent mark.

And remember, if you’re going to reach your retirement goals, you can’t do it alone. King Solomon, one of the wisest men who ever lived, wrote: “Where there is no counsel, the people fall; But in the multitude of counselors there is safety” (Proverbs 11:14 NKJV). That’s why you need a quality financial advisor—one with the heart of a teacher—to help you navigate complicated financial issues, and guide you toward the kind of retirement you want.

Do you see what I’m saying here, Carlotta? I want you—not the company you work for—to control your financial destiny. I want you to be able to retire with dignity, and enjoy life after working hard and saving. The responsibility for making that happens falls to you!

—Dave

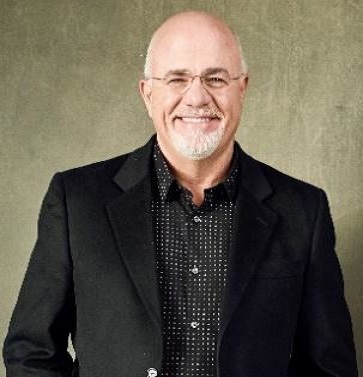

* Dave Ramsey is an eight-time national bestselling author, personal finance expert and host of The Ramsey Show. He has appeared on Good Morning America, CBS This Morning, Today, Fox News, CNN, Fox Business and many more. Since 1992, Dave has helped people take control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.

.jpg)